Kosmos Energy drills first Offshore Exploration Well in Suriname

April 8, 2018

30BN BOE WAITING TO BE DISCOVERED

August 10, 2022Suriname Confirms Commitment To Fiscal Stability Clauses In PSC'S With IOC's

I. Background

The Council of Ministers of Suriname has recently approved a draft state decree (staatsbesluit) which aims to provide clarity to IOC’s on the legal status of the Fiscal Stability Clauses and other commitments made to them in their PSC’s with Staatsolie, the NOC of Suriname. The state decree will become effective after it has been signed by the President of the Republic of Suriname and published in the Official Gazette of Suriname. Before signing the President will consult the State Council (Staatsraad) for advice. The State Council generally consults with relevant stakeholders before submitting its advice to the President.

The Explanatory Note to the draft state decree describes that it is based on Article 15, paragraphs 2 and 3 of the Petroleum law 1990 and should be considered in view of the development of the oil and gas industry in Suriname.

These articles of the Petroleum law provide for that upon written request of Staatsolie, the Government, by state decree, may issue a guarantee to the Contractor concerned, with regard to:

- Safeguarding the rights and claims of the contractor under the PSC, to the extent the Government is authorized thereto and

- Stabilizing the fiscal position of the Contractor at the time the PSC comes into effect, pursuant to the provisions of the Constitution (of the Republic of Suriname) in this matter.

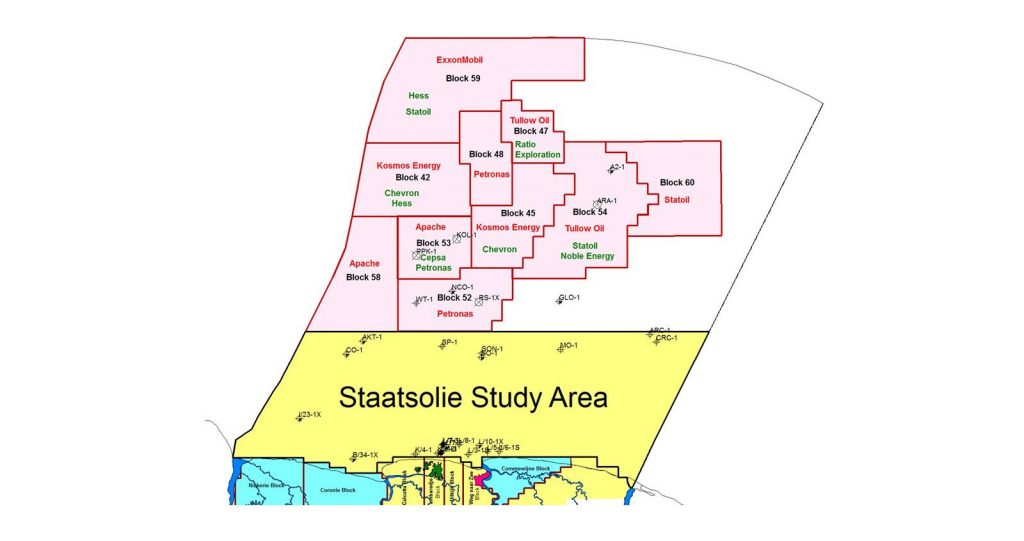

As noted in one of my previous posts, expectations are high that Suriname may soon hit the first oil discovery in its Offshore Area. Staatsolie’s CEO, Rudolf Elias,

in a presentation last January to the Trinidad and Tobago Energy Conference and Trade Show 2018, announced that its current PSC-partners will drill four Exploration Wells in 2018. The first of which is scheduled to be drilled in April by Kosmos Energy Suriname in Offshore Block 45.

But there is also a growing concern at the side of the IOC’s about the legal status and the interpretation of commitments made to them in the PSC’s with Staatsolie, especially with regard to the Fiscal Stabilization Clauses included in the PSC’s.

With this state decree the Government says to respond to a call from the IOC’s to provide clarity in these issues.

II. State decree regarding provisions for PSC partners of Staatsolie

The official title of the regarding draft state decree is “Staatsbesluit houdende voorzieningen ten behoeve van Contractors en Contractorpartijen die met de staatsonderneming Staatsolie Maatschappij Suriname N.V. een Petroleum-overeenkomst zijn aangegaan in de zin van de Petroleumwet 1990”.

In Article 2 of the draft state decree Suriname (as State) recognizes that in compliance with Article 5 of the Petroleum law 1990, it is fully aware of all commitments made to IOC’s in their PSC’s with Staatsolie and confirms that the provisions of the state decree shall apply to all existing and future PSC’s signed with Staatsolie.

Although Suriname is not (directly) a Party to the PSC’s, all PSC’s are subject to approval by the Minister of Natural Resources after being authorized to that end by the Government of Suriname. Consequently Suriname may be considered to have endorsed all commitments made therein. Article 2 of the draft state decree therefore should be seen as a confirmation of this.

Article 3 of the draft state decree provides for that Suriname guarantees to fulfill as its own primary obligations all commitments made to each PSC-partner of Staatsolie. This is quite understandable in view of the foregoing.

Actually most of the issues addressed in the state decree are a reaffirmation of what originally has been provided for in the Petroleum law and the PSC’s

(and to some extent has been confirmed in rulings of the Tax Authorities). But some of them are new and quite far-reaching from a legal point of view. Without having the intention to be complete in this regard, among others the following is included in the draft state decree:

- Article 3, sub d: Suriname shall at any time during the PSC not enter into any international/intergovernmental agreement or issue any national legislation or regulation, which in any way could impede any right or the concession area granted under the PSC, except when such is required by international law or pursuant to the Constitution;

- Article 3, sub e: notwithstanding abovementioned sub d, in case Suriname may decide to expropriate or nationalize any interest or property of a Contractor, Suriname ensures immediate compensation to the contractor to its full value in US dollar (…);

- Article 4, sub f: Suriname affirms that all liabilities and exemptions applicable to (sub-) contractors and their employees with regard to taxes and other payments to the government shall be treated as provided for in the regarding PSC and this state decree; any change in (existing) tax legislation or regulations and policies, which are not applicable to all taxpayers in Suriname shall not adversely affect the rights and exemptions granted to Contractor under the PSC or this state decree (…);

- Article 4 sub g: Suriname affirms that Contractors are exempt from and shall not be subjected to any existing or new tax related to:(i) (Turnover) tax on the sale or purchase of goods or the supply of services, including, but not limited to, any applicable taxes raised under the Turnover tax Code (Wet Omzetbelasting 1997) or any alteration (substitution?) thereof;(ii) Tax on dividends paid by a Contractor to non-resident shareholders, transfer of profits to a Head Office abroad or re-transfer of dividends by non-resident shareholders, among which taxes raised under the Dividend Tax Code (Wet Dividendbelasting 1973) or any alteration (substitution?) thereof;(iii) Tax on the sale of an interest arising from the PSC or the sale of shares of a Contractor by non-resident shareholders, proceeds from the sale of such interests or shares and transfer of such proceeds pursuant to the Stamp Duty Code (Zegelwet 1872), or any alteration (substitution?) thereof.

- Article 4, sub i: Suriname affirms that the rights and benefits obtained by Contractor under the PSC and this state decree shall not be amended, adjusted or limited without prior consent of Contractor; in case a treaty, intergovernmental agreement, legislation, state decree, or regulation, which is not applicable to all taxpayers in Suriname has a substantial adverse impact on the rights and interests granted to Contractor under the PSC or this state decree (possible changes in the jurisdiction of the contract area, tax and other legislation, regulations or policies included) the government shall compensate contractor for each damage, adverse impact of economic benefit (…); Suriname shall undertake all necessary actions pursuant to the preceding principles to immediately solve any conflict between the PSC and/or this state decree and such treaties, intergovernmental agreements, legislation, state decrees, or regulations.

- Article 4, sub j: Suriname affirms non-disclosure of all information and other data provided to the government, its ministries, departments and other government agencies.

III. Concluding remarks

The government of Suriname should be commended for its efforts to provide clarity and comprehensibility to the PSC-partners of Staatsolie.

However, my first impression after reading the draft state decree is that on some points there is room for improvement to reach the clarity and comprehensibility the Government is aiming at. In particular in view of the far- reaching impact of some of the provisions.

The draft state decree is a very complex document. Partly because the wording in Dutch (which is the official language in Suriname) is lengthy and in some cases seems rather inconsistent, which makes it difficult to access and quite confusing. E.g. the Dutch word “Regering” is used where “(de Staat) Suriname” or “de Staat” probably would be more appropriate.

It further seems that some issues are (repeatedly) addressed in different articles, which makes it difficult to determine what actually should apply.

E.g. Article 4, sub f, Article 4 sub g and Article 4, sub i, with regard to taxation issues (Fiscal Stabilization).

But more fundamentally, it seems to me that some provisions with regard to tax issues do not (fully) comply with Article 155 of the Constitution, which mandatorily provides for that

- Taxes are raised compliant with the law, which law provides for the tax burden, the rates, exemptions and safeguards for taxpayers

- No incentive (exemption) with regard to taxes shall be granted other than pursuant to the law.

The term “law” in this regard refers to the principle that any issue related to taxation and tax related incentives should be approved by the Parliament.

That basically can be done by either the Parliament approving such incentive in a (separate) law or by Parliament approving a law in which it mandates the Government to provide for such (specifically mentioned) incentives in a state decree.

The Preamble of the state decree refers to Article 15, sub 2 and 3 of the Petroleum law as justification for the provisions included in the state decree.

But since these Articles explicitly refer to “to the extent that Government is authorized thereto (safeguarding rights and claims of contractors)” and “pursuant to the provisions of the Constitution on this matter (Fiscal Stabilization)”, I actually doubt whether this provides sufficient legislative basis for the state decree.

In view of this I therefore recommend that it should be examined whether the Government is (really) authorized hereto and whether in case of the Fiscal Stabilization issues, the Government has done this compliant with Article 155 of the Constitution.

To limit myself to the Fiscal Stabilization issues, it is my preliminary opinion that, except for the Income tax, the provisions in the state decree related to taxation and tax incentives for Turnover tax, Dividend tax and Stamp duty actually do not comply with Article 155 of the Constitution.

Fiscal Stabilization with regard to Income tax has been (correctly) provided for in an amendment to the Petroleum law in 2001, which resulted into insertion of a paragraph 8 to Article 9 of the law and reads as follows:

“A Contractor, pursuant to the Income tax Law of 1922, shall be subject to income tax pursuant to the rates applicable on the date that the petroleum agreement (PSC) enters into force. In case the tax rates are adjusted, such adjustment shall not be applicable to the contractor and shall have no influence on his liability to pay taxes pursuant to the Income tax Law of 1922”.

I am not aware of any such provision in the Petroleum law or in respectively the Turnover Tax Code, the Dividend Tax Code or the Stamp Duty Code, which allows incentives (of a general nature) as included in the draft state decree with regard to these taxes.